27+ Mortgage what can we borrow

Capital and interest or interest only. Mortgage rates today are very reasonable for fixed-rate 10- 15- or 30-year mortgages.

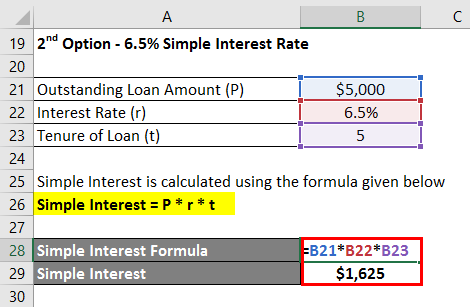

Interest Formula Calculator Examples With Excel Template

Whats more a Retirement Interest Only Mortgage doesnt have to be repaid until you die or permanently move into long-term care.

. This loan is paid back in a series of. The new borrower wouldnt have to apply for a new loan pay for closing costs or possibly risk paying higher interest rates. Bridge loans let homebuyers take out a loan against their current home in order to make the down payment on their new home.

Itll tell you if you can afford the mortgage or not. However many kinds of. So we will be able to let you know how much you can borrow depending on your employment status income and affordability calculations and also what it will cost including all associated costs and fees.

A mortgage is one of the biggest commitments youll make in your financial life. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time. Because home equity is the difference between your homes current market value and your mortgage balance your home equity can increase in a few circumstances.

5 months 27 days. A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments. The comparison rates are based on a loan for 150000 and a term of 25 years.

Also if you can afford it it will precisely calculate your loan with taxes and PMI so you can know what to expect each month. We are an expert mortgage broker with access to over 12000 mortgage products from more than 90 UK lenders. When you make mortgage payments.

Modified Tenure Payment Plan. Locking in a low rate is a smart choice. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

There are two different ways you can repay your mortgage. The reason is simple. Are you struggling financially.

We do not offer additional loans above a maximum LTV of 85 including your existing mortgage. This type is backed by collateral. If youre struggling financially and would like to speak to someone for free financial advice information and assistance you can call the Financial Counsellors.

Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes. This loan including interest is paid at a specified future date. With a capital and interest option you pay off the loan as well as the interest on it.

Who can get a mortgage in the Netherlands. Loans can be further classified as under. Its good to know that having a different nationality is often no longer an obstacle to getting a Dutch mortgage.

If youre planning to buy a house in the Netherlands then it might be good to know whether its actually possible at allAnd often it is regardless of whether youre employed or have your own business. And mortgage lenders and banks arent particularly keen on lending to homeowners who couldnt pay their home loan on time in the past. Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022.

2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates. Interest rates have. Maximum additional loan term is 25 years if any element of your mortgage is on interest only.

The mortgage should be fully paid off by the end of the full mortgage term. But with so many possible deals out there it can be hard to work out which would cost you the least. If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190.

With our calculator you can enter the portion of the homes cost you plan to pay upfront as either a percentage or a dollar value. A Retirement Interest Only Mortgage can be used to repay an existing mortgage. The interest on a mortgage is calculated monthly and is part of your annual percentage rate or APR which also includes the fees you have to pay the bank to borrow the money.

With an interest only mortgage you are not actually paying off any of the loan. A bridge loan may be a good option for you if you want to purchase a new. This type of loan has no collateral typically means higher risk and thus demands higher interest.

Our mortgage calculator helps by showing what youll pay each month as. Were in for a little bit more pain The rapid climb in mortgage rates finally paused this week but elevated borrowing costs continue to stifle price-rattled buyers. The many different types of mortgage loans available today biweekly payment plans how to shop for a mortgage steps in the mortgage application process loan closing activities and closing costs the refinance process second mortgages option ARM loans 15-year fixed loans 100 financing interest-only loans 228 or 327 ARMs hybrid.

Rate applies for new loans when you borrow up to 60 of the property value with a principal and interest repayment variable rate loan. If any of these details change then the mortgage amount well offer may change. You may be able to borrow.

This specific mortgage loan calculator or also known as a home loan calculator is the tool you want to use prior to getting a mortgage loan. But you can get lower mortgage rates with some adjustable-rate. Subject to change without notice.

Simply put mortgage lates severely damage your credit score. Transferring a mortgage can simplify things. However because of the frequency of mortgage lates committed by homeowners in recent years some mortgage lenders and banks now allow one 30-day mortgage late in the past 24.

A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term.

27 Simple Ways To Build A Family Travel Fund Packed For Life

Stylish Master Bedroom Design Ideas Budget 15 Largeluxurymasterbedrooms Stylish Master Bedrooms Contemporary Bedroom Bedroom Interior

Free 27 Printable Client Information Sheet Templates Real Estate Forms Real Estate Client Real Estate Tips

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

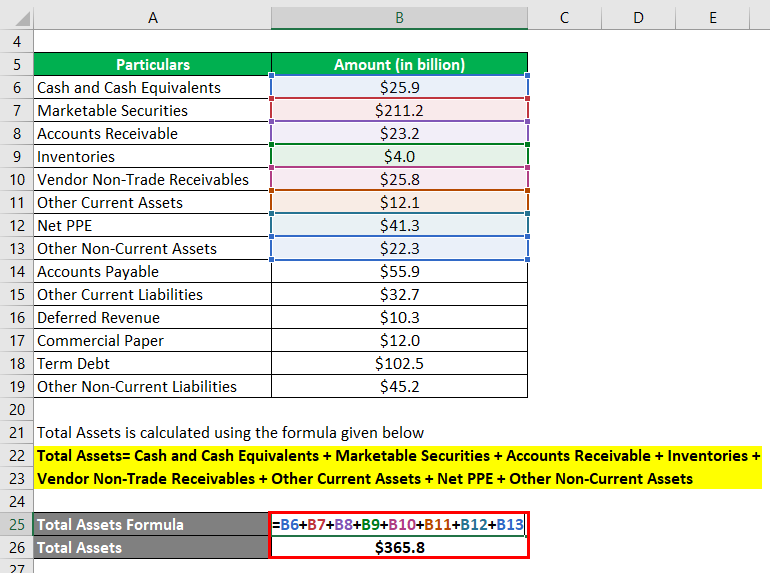

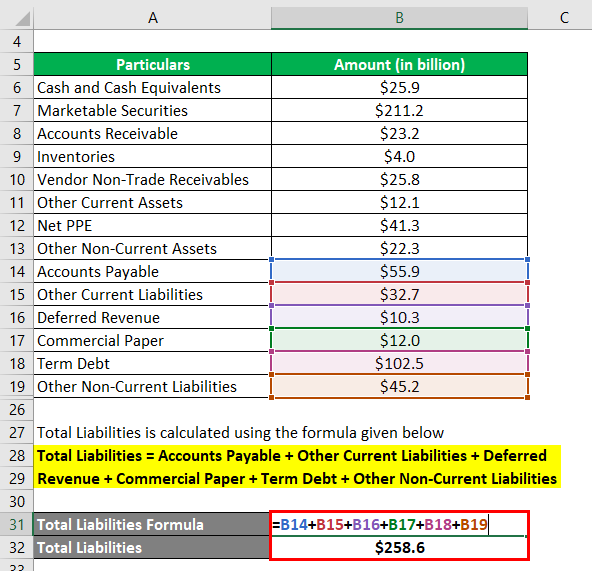

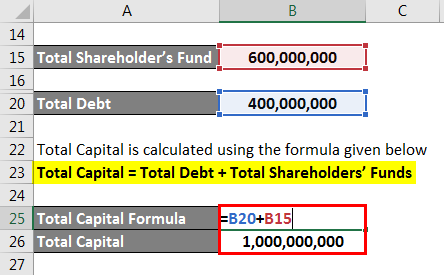

Net Worth Formula Calculator Examples With Excel Template

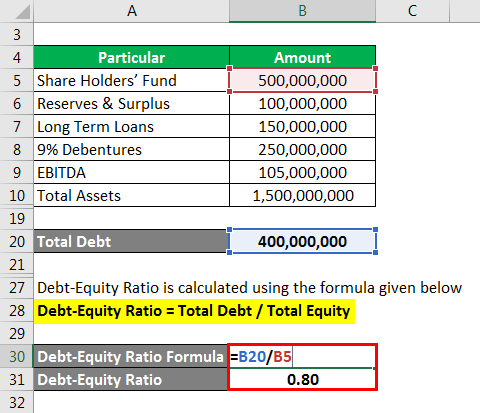

Leverage Ratio Explanation Types And Example

The Best 27 Passive Income Ideas For 2022 Money Life Wax

Net Worth Formula Calculator Examples With Excel Template

Asset Financing A Complete Guide On Asset Financing With Explanation

Cost Of Preferred Stock Preferred Vs Common Stock Vs Debt

27 Cover Letter For Graduate School Resume Cover Letter Examples School Template Lettering

27 Cover Letter Starters Job Cover Letter Cover Letter Example Letter Example

Maturity Value Formula Calculator Excel Template

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

Leverage Ratio Explanation Types And Example

27 Starting A Cover Letter Resume Cover Letter Examples Sample Resume Templates Cover Letter For Resume

013 Free Printable Checks Template Of Editable Blank Check Inside Customizable Blank Check Template Printable Checks Templates Printable Free Blank Check